Review

Canadian cannabis sales increased 5.3% sequentially to C$428.6 million in April, up just 4.4% from a year ago.

I shared this article at Seeking Alpha:

-

Trulieve Is No Longer A Sell (Rating Upgrade)

Here are some of this week’s highlights for Focus List names:

- AAWH opened its fourth Pennsylvania dispensary and relocated one of them.

- CBSTF announced that it will exit the Florida market.

- CRON will lend GrowCo a substantial amount of money.

- GTBIF opened its 17th dispensary in Florida

- PLNH launched a Fight Club in Las Vegas.

- TLRY introduced the Broken Coast product in Australia.

- VFF shared that it will begin shipping cannabis to Netherlands in early 2025.

- VRNOF announced a share repurchase authorization. It filed an answer to Goodness Growth’s lawsuit. The company added two new Florida dispensaries.

Market Performance

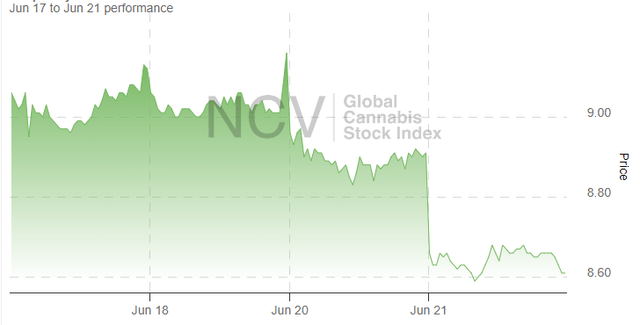

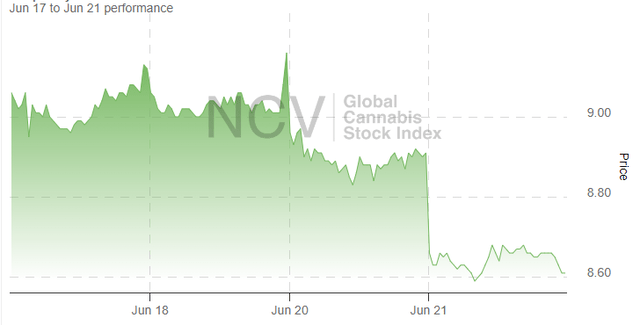

The Global Cannabis Stock Index fell again Friday, and it dropped 7.1% for the week to 8.61. This was worse than 0.6% gain in the S&P 500. In 2023, GCSI decreased 16.5%, while the S&P 500 was up 24.2%. In 2024, the S&P 500 is up 14.6%, while the GCSI has gained 6.2%:

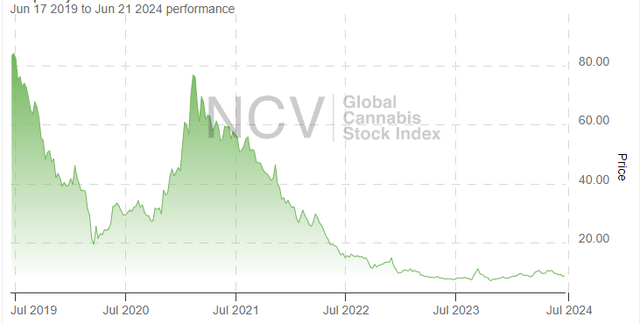

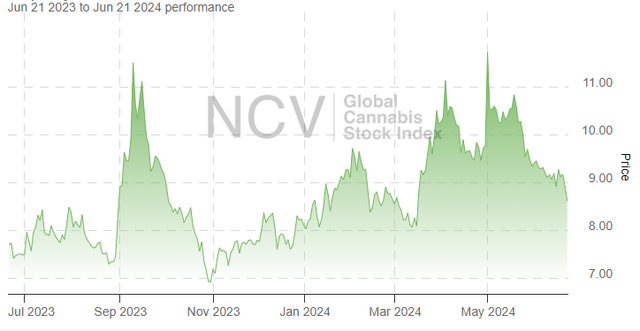

The index, which lost 26% in 2021 following a 5.2% gain in 2020, was down 70.4% in 2022 and then fell 16.5% in 2023. It currently includes 29 stocks and ended the year at 8.11:

The index, which lost 26% in 2021 following a 5.2% gain in 2020, was down 70.4% in 2022 and then fell 16.5% in 2023. It currently includes 29 stocks and ended the year at 8.11:

For perspective, the index, which began 2013 at 100, bottomed in August 2013 at 70 after a prior peak of 220 in February 2013 and peaked in 2014 at 1010. The long post-2014 decline ended in February 2016, with the market soaring at the beginning of 2018 to levels not seen since 2014. We took out the 2016 lows by a wide margin in early 2020 and then soared into 2021 before reversing. We made a new all-time low at the end of September 2022 and then several others, the last of which was in October 2023:

For perspective, the index, which began 2013 at 100, bottomed in August 2013 at 70 after a prior peak of 220 in February 2013 and peaked in 2014 at 1010. The long post-2014 decline ended in February 2016, with the market soaring at the beginning of 2018 to levels not seen since 2014. We took out the 2016 lows by a wide margin in early 2020 and then soared into 2021 before reversing. We made a new all-time low at the end of September 2022 and then several others, the last of which was in October 2023:

Model Portfolios

I launched two new model portfolios at the end of 2022. Beat the Global Cannabis Stock Index is a core model portfolio that replaces 420 Opportunity and 420 Quality. Beat the American Cannabis Operator Index is a new one that is focused on MSOs and aims to beat the ETF MSOS as well as the index for which it is names. Unlike the Benzinga platform, they are just a spreadsheet that is based on the closing prices for trades. In time, Seeking Alpha will be offering a real-time platform.

Beat the Global Cannabis Stock Index was down this week, rising 6.4% to $100,526, much better than the index, which lost 7.1%. In 2023, it was down 15.2%, while the index lost 16.5%. In 2024, the model portfolio is up 18.6%, which is ahead of the index at up 6.2%. Since inception, the model portfolio is up 0.5%. During the week, I added to MAPS, reducing AAWH and CBSTF to fund the purchases on Monday. On Tuesday, I reduced CBSTF and added to PLNH and reduced MAPS to add some AAWH. On Thursday, I reduced CBSTF and added to OGI and added back GRWG, trimming AAWH, CBSTF and MAPS. I also boosted VFF. On Friday, I reduced PLNH to buy more AAWH, and I also boosted VFF. Later, I reduced HYFM to boost GRWG.

Beat the American Cannabis Operator Index gained 0.3% this week to $68,322, worse than the index, which gained 3.2%. MSOS ended the week up 5.2%. In 2023, the model portfolio lost 10.2%, while the index was up 7.6%. MSOS gained 0.3% in 2023. In 2024, the model portfolio is down 23.7%, while the index has gained 0.1%. MSOS has increased 4.9%. Since inception, the model portfolio has dropped 31.5%. During the week, I did no trades.

Calendar

New Cannabis Ventures posts a calendar of industry events. NCV also posts a separate calendar for conference calls.

During the week, no events are scheduled.

Companies with fiscal years ending in March (February for Canadian Venture stocks that don’t file with the SEC) must report their annual financials in June. Companies with years ending in July, October or January must file their quarterly reports by mid-June (or by late June for Canadian-listed stocks that aren’t on the TSX or NEO or filing with the SEC).

New Cannabis Ventures Update

Here are some of the most interesting stories we published on New Cannabis Ventures.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.